The recommended way to find cheaper auto insurance rates in Pittsburgh is to make a habit of comparing prices annually from companies in Pennsylvania. You can compare prices by following these guidelines.

The recommended way to find cheaper auto insurance rates in Pittsburgh is to make a habit of comparing prices annually from companies in Pennsylvania. You can compare prices by following these guidelines.

First, read and learn about the different coverages in a policy and the things you can control to prevent expensive coverage. Many policy risk factors that are responsible for high rates like getting speeding tickets and an imperfect credit score can be amended by paying attention to minor details.

Second, quote rates from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can give quotes from one company like Progressive and State Farm, while independent agents can quote rates from multiple companies.

Third, compare the new quotes to the price on your current policy to see if a cheaper rate is available in Pittsburgh. If you find a better price and change companies, make sure the effective date of the new policy is the same as the expiration date of the old one.

A key point to remember is to compare similar deductibles and liability limits on every quote and and to get quotes from as many carriers as you can. This provides an accurate price comparison and the best price selection.

We don’t have to tell you that car insurance companies don’t want you to look for cheaper rates. People who shop around for the cheapest rate will probably switch companies because there is a significant possibility of finding a lower-priced policy. A recent survey discovered that consumers who regularly compared price quotes saved as much as $3,450 over four years compared to policyholders who never shopped for cheaper rates.

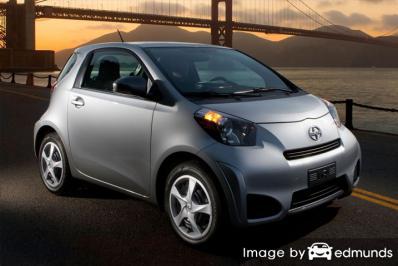

If finding low prices for Scion iQ insurance is the reason you’re here, then having an understanding of the best way to shop and compare insurance can make it easier to shop your coverage around.

If you already have coverage, you will definitely be able to find the best rates using the concepts you’re about to learn. Our objective is to introduce you to how to get online quotes and some money-saving tips. Nevertheless, Pennsylvania vehicle owners must comprehend how companies determine prices and use it to find better rates.

Ways to get Scion iQ insurance rate quotes in Pittsburgh, Pennsylvania

When quoting insurance, remember that comparing more prices helps you find a lower rate.

The companies shown below are our best choices to provide free rate quotes in Pennsylvania. To find the best auto insurance in Pittsburgh, PA, we recommend you visit several of them to get the cheapest price.

Pittsburgh auto insurance discounts

Car insurance companies don’t always advertise all available discounts very well, so we took the time to find both well-publicized as well as some of the hidden savings tricks you should be using when you buy Pittsburgh auto insurance online.

- New Vehicle Savings – Putting auto insurance coverage on a new iQ may earn a small discount because new model year vehicles keep occupants safer.

- Cautious Driver Discounts – Safe drivers can get discounts for up to 45% lower rates than their less cautious counterparts.

- Defensive Driver Discount – Taking part in a driver safety course could cut 5% off your bill and easily recoup the cost of the course.

- Paper-free Discount – Some companies provide a small discount for completing your application on the internet.

- Early Payment Discounts – If you pay your entire premium ahead of time rather than paying in monthly installments you can avoid monthly service charges.

As a footnote on discounts, most credits do not apply to the overall cost of the policy. Most only apply to the cost of specific coverages such as liability and collision coverage. So even though they make it sound like it’s possible to get free car insurance, you aren’t that lucky.

A list of companies and their possible discounts are:

- Progressive has savings for multi-vehicle, homeowner, online quote discount, good student, and online signing.

- The Hartford includes discounts for bundle, driver training, air bag, defensive driver, good student, vehicle fuel type, and anti-theft.

- Mercury Insurance policyholders can earn discounts including accident-free, good student, location of vehicle, annual mileage, type of vehicle, and multi-policy.

- GEICO has discounts for good student, multi-policy, multi-vehicle, military active duty, and emergency military deployment.

- AAA offers discounts including pay-in-full, good student, AAA membership discount, multi-policy, anti-theft, and education and occupation.

- State Farm may offer discounts for driver’s education, Steer Clear safe driver discount, accident-free, passive restraint, and defensive driving training.

When getting a coverage quote, ask all companies you are considering which credits you are entitled to. A few discounts may not be available in Pittsburgh. If you would like to view providers that can offer you the previously mentioned discounts in Pittsburgh, click here.

Choosing the best iQ insurance in Pennsylvania is an important decision

Even though Pittsburgh iQ insurance rates can get expensive, maintaining insurance is mandatory in Pennsylvania but it also protects more than you think.

- Almost all states have mandatory liability insurance requirements which means you are required to buy a minimum amount of liability if you drive a vehicle. In Pennsylvania these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If you took out a loan on your iQ, almost all lenders will require you to have insurance to protect their interest in the vehicle. If you let the policy lapse, the lender may have to buy a policy to insure your Scion at a much higher premium rate and require you to pay the higher premium.

- Insurance protects not only your car but also your assets. It will also pay for medical expenses for both you and anyone you injure as the result of an accident. As part of your policy, liability insurance also pays expenses related to your legal defense if you are named as a defendant in an auto accident. If damage is caused by hail or an accident, collision and comprehensive coverages will pay to restore your vehicle to like-new condition.

The benefits of having auto insurance more than offset the price you pay, particularly for liability claims. As of last year, the average driver in Pennsylvania overpays as much as $800 each year so we recommend shopping around every year to help ensure money is not being wasted.

When to get professional advice

Always keep in mind that when comparing a policy for your vehicles, there really is no “perfect” insurance plan. Your needs are not the same as everyone else’s so this has to be addressed.

These are some specific questions might help in determining whether your personal situation could use an agent’s help.

- How high should my medical payments coverage be?

- Who is covered by my policy?

- If I drive on a suspended license am I covered?

- Should I carry comprehensive and collision coverage?

- When should my teen driver be added to my policy?

- Can my babysitter drive my car?

- Are my tools covered if they get stolen from my vehicle?

- Does my policy cover me if I wreck while driving under the influence?

If you don’t know the answers to these questions then you might want to talk to a licensed agent. To find an agent in your area, take a second and complete this form or you can also visit this page to select a carrier

Car insurance agents near you

Some people just want to buy from a licensed agent and there is nothing wrong with that. An additional benefit of price shopping on the web is that you can find cheap car insurance rates and still have an agent to talk to. And buying from local agents is especially important in Pittsburgh.

For easy comparison, once you complete this form (opens in new window), your insurance data is immediately sent to insurance agents in Pittsburgh that give free quotes to get your business. It’s much easier because you don’t need to visit any agencies since price quotes are sent immediately to you. You can find the lowest rates and an insurance agent to talk to. If for some reason you want to compare rates from a specific insurance company, feel free to jump over to their website to submit a rate quote request.

For easy comparison, once you complete this form (opens in new window), your insurance data is immediately sent to insurance agents in Pittsburgh that give free quotes to get your business. It’s much easier because you don’t need to visit any agencies since price quotes are sent immediately to you. You can find the lowest rates and an insurance agent to talk to. If for some reason you want to compare rates from a specific insurance company, feel free to jump over to their website to submit a rate quote request.

If you need to find local Pittsburgh agents, you should know the types of insurance agents and how they can service your needs differently. Car insurance agencies are classified as either exclusive or independent.

Independent Car Insurance Agencies

Agents of this type often have affiliation with several companies and that enables them to quote your coverage with multiple insurance companies and find you the best rates. If your premiums go up, your agent can just switch to a different company and the insured can keep the same agent.

When comparison shopping, we highly recommend that you get some free quotes from several independent insurance agents in order to compare the most rates. Many write coverage with small regional insurance companies which can save you money.

The following is a small list of independent insurance agents in Pittsburgh that may be able to provide rate quotes.

- Feeney Insurance Agency

1350 Old Freeport Rd – Pittsburgh, PA 15238 – (412) 963-8850 – View Map - Nationwide Insurance: Barry Lumsden

600 Grant St – Pittsburgh, PA 15219 – (412) 415-1954 – View Map - Preston and Grafton Insurance Agency

2012 Murray Ave – Pittsburgh, PA 15217 – (412) 586-7340 – View Map

Exclusive Insurance Agents

Agents of this type can only provide pricing for a single company like Farmers Insurance, American Family, State Farm and Allstate. They are unable to give you multiple price quotes so if the price isn’t competitive there isn’t much they can do. These agents are well trained on the products they sell which aids in selling service over price. Drivers often use the same agent mostly because of high brand loyalty and solid financial strength.

Below are exclusive insurance agents in Pittsburgh that are able to give rate quotes.

- Donna Fleming – State Farm Insurance Agent

11203 Frankstown Rd – Pittsburgh, PA 15235 – (412) 242-5995 – View Map - George O’Korn – State Farm Insurance Agent

4486 Steubenville Pike – Pittsburgh, PA 15205 – (412) 921-1182 – View Map - Adriana Pasquini – State Farm Insurance Agent

735 Copeland St, FL2, Pittsburgh 15232 – FL2, PA 15232 – (412) 904-1268 – View Map

Finding the right car insurance agent should include more criteria than just the price. Any good agent in Pittsburgh should know the answers to these questions.

- Has the agent ever had any license suspensions?

- Are they giving you every discount you deserve?

- Do they receive special compensation for putting your coverage with one company over another?

- Can you get a list of referrals?

- Does the company allow you to choose your own collision repair facility?